Compound growth investments

The Compound Annual Growth rate is a useful tool for comparing a variety of investments over a similar investment horizon. Others have lower growth ie.

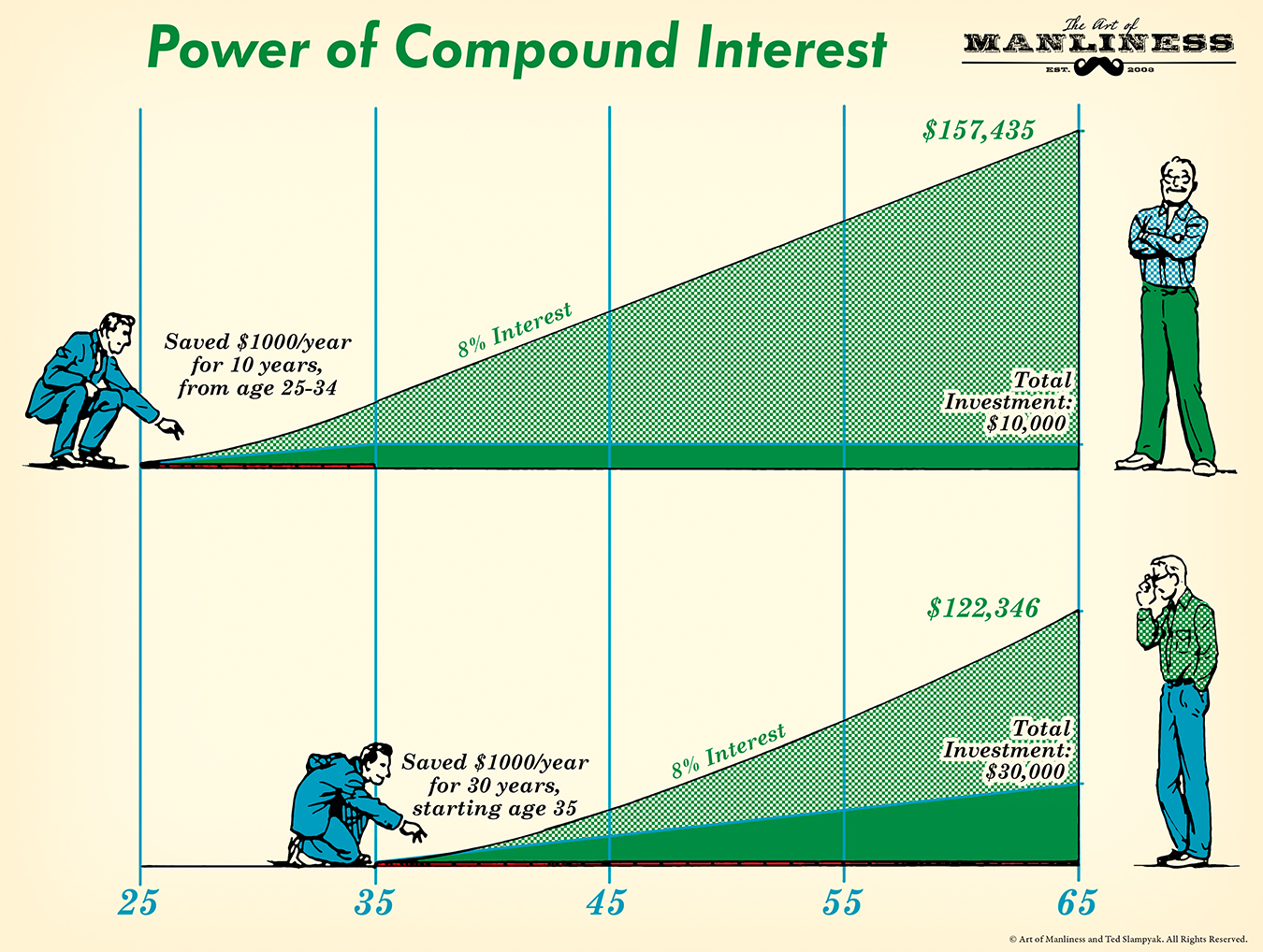

How Compound Interest Can Make You Rich

CAGR provides the growth rate as if the changes occurred evenly at the same rate over each individual period so the CAGR effectively smoothens the growth rate.

. Thought to have. AAGR is a more simplistic growth metric and doesnt account for compounding. CAGR makes it possible to compare profits from a particular investment with risk-free instruments.

When youre investing to save for retirement you should put your money in mutual funds. It also allows you to assess. Having absolutely safe money investments while still giving yourself the opportunity for long-term growth.

Determine how much your money can grow using the power of compound interest. This calculator rounds to the nearest dollar. Whenever you want to calculate revenue compound growth you have to use the trailing twelve months value to get the most updated result.

Compound Annual Growth Rate CAGR Compound Annual Growth Rate is an important investment concept thats related to compound interest. All banking calculators. Based on consensus estimates among surveyed analysts FactSet hasdetermined which stocks in the SP 500 that have the highest expected two-year dividend compound annual growth rate.

The best investments for 2022. Gave up weekly restaurant visits. CAGR allows investors to compare investments with different time horizons.

Financial institutions often offer compound interest on deposits compounding on a regular basis usually monthly or annually. The Vanguard SP 500 ETF with stock ticker VOO is a great way to generate 12 compound interest returns without having to pick individual stocks. Its value will compound at a slower rate but exist to provide more stability to your investment portfolio.

The Global Compound Management Market is estimated to be USD 911 Bn in 2022 and is expected to reach USD 196005 Bn by 2027 growing at a CAGR of 1656. This tool is intended to show growth of investments before income tax is applied. The compound growth rate is a measure used specifically in business and investing contexts that indicates the growth rate over multiple time periods.

Unlike average growth rates that are prone to volatility levels compound growth rates are not affected by. Compound interest occurs when interest is added to the original deposit or principal which results in interest earning interest. NEEDHAM Mass November 9 2021 Global spending on the digital transformation DX of business practices products and organizations is forecast to reach 28 trillion in 2025 more than double the amount allocated in 2020.

The average yearly returns of VOO have amounted to 1674 over the past 11 years. The compound annual growth rate CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year. The Internal Rate of Return IRR is the annual rate of growth that an investment or project generates over time.

This ETF has been around since 2010 and has seen tremendous growth totaling a whopping 420 since its inception. IRR follows the same principle as CAGR but makes an allowance for withdrawals or. Mutual funds dont earn a fixed interest rate.

At the end of the first year youd have 110 100 in principal 10 in interest. According to a new update to the International Data Corporation Worldwide Digital Transformation Spending Guide DX. CAGR is not an accounting term but it is often used to describe some element of the business for example revenue units delivered registered users etc.

The global thermoset molding compound market was valued at 98 billion in 2020 and is projected to reach 180 billion by 2030 growing at a CAGR of 63 from 2021 to 2030. They are sometimes also referred to. Compound savings calculator.

And that can be ok too depending on your circumstances. Now build a plan to reach 0. Instead AAGR calculates the arithmetic average of an investment.

If you need help with your investments we recommend working with an expert wholl. Compound annual growth rate CAGR is a business and investing specific term for the geometric progression ratio that provides a constant rate of return over the time period. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan.

Compound interest has dramatic positive effects on savings and investments. Thus it is especially significant in the assessment of returns from investments. CAGR dampens the effect of volatility of.

See how much interest you can earn on your investments over time with compound growth and calculate the total value of your investment over time to see what it will take to meet your investment goal. Adds 200 a month in contributions but creates 0. For example say you have 100 in a savings account and it earns interest at a 10 rate compounded annually.

One of CAGRs advantages over an average annualized rate of return is that it is not influenced by percentage changes within the investment horizon that may yield misleading results. Compound Annual Growth Rate - CAGR. Its a way to measure the growth rate of your investments over time.

This advantage can be illustrated by. The compound annual growth rate formula in Excel is often used in Excel spreadsheets by financial analysts business owners or investment managers Investment Managers An investment manager manages the investments of others using several strategies to generate a higher return for them and grow their assets. CAGR is a growth statistic that measures the compound annual return of investments over a set period of time assuming you reinvest your profits ie.

The Compound Annual Growth Rate CAGR is the annualized rate of growth in the value of an investment or financial metric such as revenue over a specified time period. All this means is that the best compound interest investments for you may not be the same for someone else.

A Visual Guide To Simple Compound And Continuous Interest Rates Betterexplained

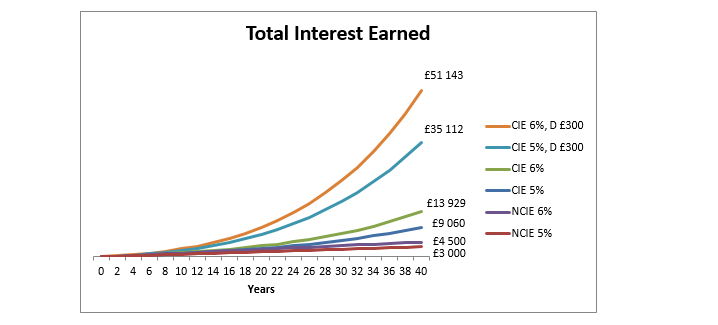

The Power Of Financial Compounding Explained In 7 Graphs Seeking Alpha

The Power Of Financial Compounding Explained In 7 Graphs Seeking Alpha

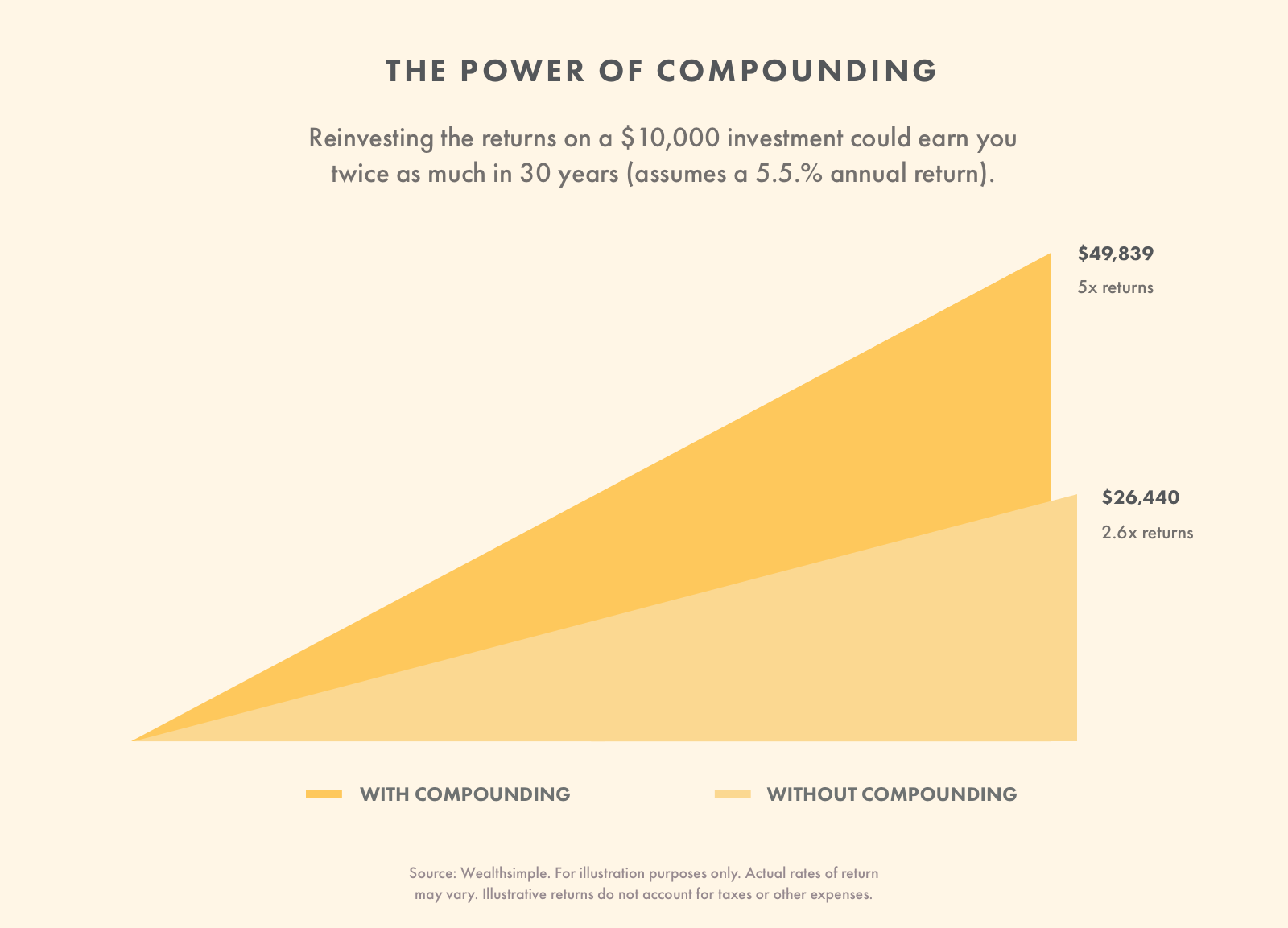

What Is Compound Interest Wealthsimple

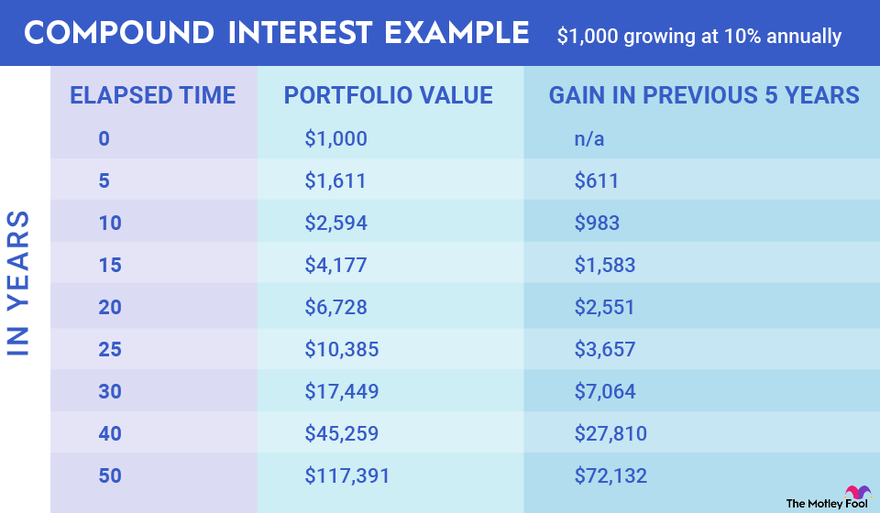

Fidelity Compound Interest

A Visual Guide To Simple Compound And Continuous Interest Rates Betterexplained

Accounts That Earn Compounding Interest

Fidelity Compound Interest

Compound Interest Formula With Graph And Calculator Link

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

What Is The Link Between Mutual Funds And Compound Interest

How Compound Interest Can Make You Rich

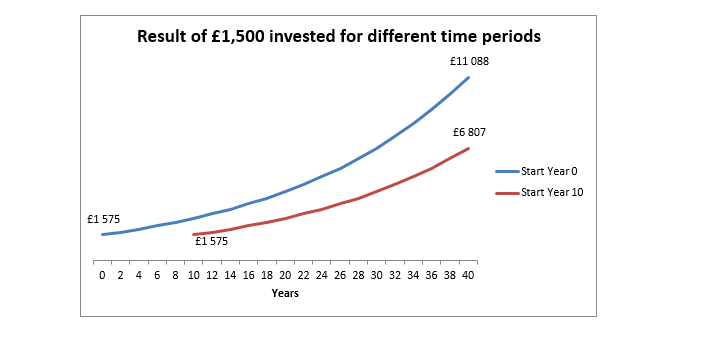

The Difference In Retirement Savings If You Start At 25 Vs 35

I Am Interested In Investing In An Index Fund But I Understand That They Re Balance Twice A Year I M Not Sure When They Do That Is There An Optimal Time To Buy

Capitalize On Uninterrupted Compound Interest Wealth Nation

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

What Is The Link Between Mutual Funds And Compound Interest

The Difference In Retirement Savings If You Start At 25 Vs 35

Understanding The Time Value Of Money Ag Decision Maker